We all know that eventually someone is going to have to deal with the issues concerning our funeral and/or memorial service; burial or cremation. As with other parts of estate planning, we have the ability to make things much easier on our loved ones by doing a little planning ahead of time.

When our office prepares an estate plan for a client, we provide them with a section in their estate planning binder to make their wishes known to their family. This includes notifying specific family members, friends, and organizations of the individual's passing. We also provide forms for our clients to set forth their personal information; sections for handling of remains and marker selection; casket or urn selection; information concerning a remembrance/funeral service; and information regarding costs and expenses. In the United States for the last twenty-five years certain wealthy families have been taxed differently than other wealthy families solely as a result of when the wealth was accumulated.

Trusts have been around for hundreds and hundreds of years. Even living trusts have been around for a long time. Today estate planning attorneys in most states routinely recommend a living trust to their clients. For example in California – it does not matter if a client is in Los Angeles, Manhattan Beach, Culver City or anywhere else in the state – it has been this way for well over twenty years. In the eastern United States, it has been a shorter period of time.  Estate Planning attorneys are sometimes asked to prepare premarital agreements. When I am asked, it is usually because at least one of the spouses is “older” or is because it is a second marriage for at least one of the spouses. People often attempt to take shortcuts in the execution of premarital agreements. Shortcuts can invalidate the agreement. In California, premarital agreements have to meet certain requirements for them to be considered valid by the court in the event the marriage dissolves and one party seeks to implement the agreement. Obviously it is an important issue! Many business owners have created a very successful business by working incredibly hard to develop something that is worth a fair amount of money. Unfortunately, a lot of these same people have not implemented a succession plan.

Many of these same people do have an Estate Plan, including a well drafted Living Trust – obviously some do not – but it is silent regarding the business. When planning ahead to protect the legacy that you have created, creating a thoughtful business succession plan is vital. Depending on the size and nature of the business, it may require the company's CPA, a financial advisor, an insurance professional, and an estate planning attorney. Watch out for those estate planning attorneys! Linda Nell Lowney was an estate planning attorney for many years. In 2005 she became romantically involved with a client of hers, Thor Tollefsen.

Mr. Tollefsen was in his mid-eighties and 30 years older than Ms. Lowney, had emphysema and terminal cancer, and was using a walker when he married her in 2006. They married under a confidential marriage license that wrongly stated that the two were living together. Shortly after they were married, Mr. Tollefsen complained to relatives that his wife was not taking care of him as she had promised to do and he began living in a senior care facility. When he died, his relatives discovered that Lowney had the remainder of the $340,000 that he had transferred to her less than 2 years earlier expecting that she would pay for his care with the money. Ms. Lowney had argued before the State Bar of California that she had been given the money as his girlfriend and not as his attorney. I was reading an interesting blog on royalties and their value to estates after the death of the creator of the work.

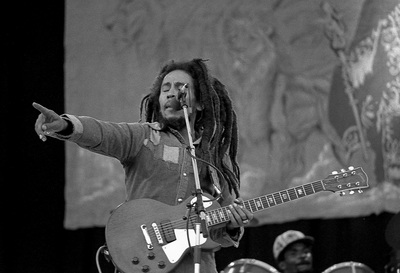

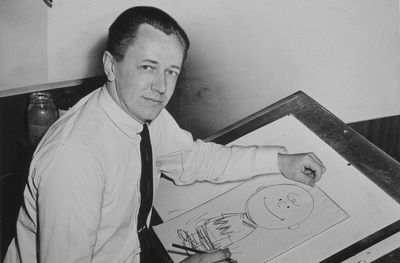

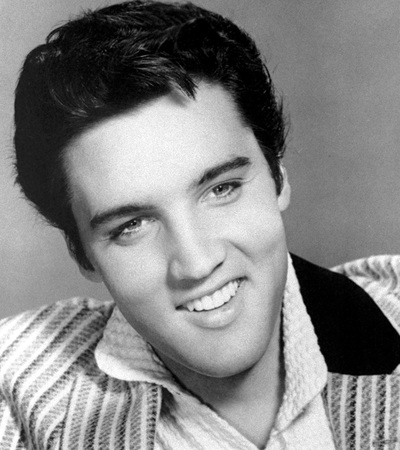

The author, Peter J. Reilly, cited a recent Forbes list that indicated among other things that the JRR Tolkien estate is good for $7 million dollars annually. The blog focused on the J.D. Salinger estate and the steps that J.D. Salinger took to keep his writings from being exploited after his death. After reading the blog, I Googled and found a video from a Forbes writer wherein she provided the amounts that the 5 largest celebrity estates earned from October 2011 until October 2012. I found that taking a look back at this list was very interesting, and worth sharing.  As I mentioned in a previous post, as a parent selecting a guardian for your children is one is the hardest steps in creating an Estate Plan. Even the thought of not being around to raise your children is enough to solidify the hesitation of creating an Estate Plan for many people. Many parents begin planning for their child’s future even before they are born. An Estate Plan should be a facet of this planning. Because selecting a guardian can be overwhelming, I advise my clients to start small. Make a list of traits that you want to have in a guardian, as well as a list of values that are important for you to pass on to your children. It also helps to rate the traits and values in terms of their importance to you. I recommend having each parent make his or her own list and then discuss them together. People put off drafting their Estate Plans for a variety of reasons. Over the past twenty-five years in my Culver City office I have heard everything from “Estate Planning is only for the wealthy, not me” to “if I make a plan, I will die because the plan is already in place.” These and other Estate Planning misconceptions are for another post, for now I would like to focus on Estate Planning for parents.

One of the largest obstacles that keeps parents from meeting with an Estate Planning attorney is the issue of guardianship. As a parent choosing the best school, packing the perfect lunch, and checking for monsters under the bed are all standard, but entertaining the idea of who you would select to do these things if you could no longer do them is an emotional process. For anyone, thinking about the decisions that they would make for their loved ones after they have passed is difficult, in many respects this becomes even harder as a parent.  Almost every client asks me where they should keep their Estate Planning documents. And every time I explain that there is not a perfect answer. Historically, many people left the originals with the attorney who drafted the documents. I am not a proponent of that, and in fact retain only two client’s original documents. Both of those clients requested that I do so. I think that one of the reasons some Estate Planning attorneys keep the original documents is because it insures that they would get future business from the client's family when the Trust was executed. I recommend that my clients keep their Living Trust; Wills and other Estate Planning documents in an easily accessible place. Moreover, I suggest that they inform their successor trustee/executor where they are kept. |

Categories

All

Michael Burstein

Estate Planning and Probate Attorney, Manhattan Beach Local, Sports Enthusiast

Archives

April 2023

|

|

LOS ANGELES

3611 Motor Avenue, Suite 220 Los Angeles, California 90034 Tel: (310) 391-1311 Fax: (310) 391-4853 |

MANHATTAN BEACH

111 North Sepulveda Blvd. Suite 250 Manhattan Beach, California 90266 Tel: (310) 545-7878 |

Connect With Us

|

RSS Feed

RSS Feed