|

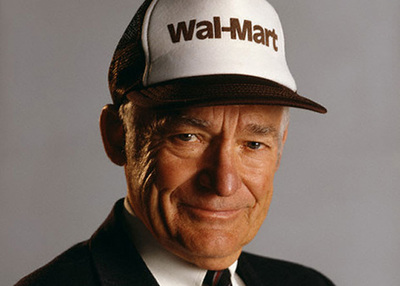

For the most part, the results of our work are not seen by our clients. When we prepare an Estate Plan for someone, it is generally not implemented until the client’s incapacity or death. What other professions is that true about? You go to the accountant or to the doctor, or to the dentist, or to the mechanic – well you get the picture – and you see the results fairly quickly. When you ask your friends for recommendations or read recommendations on the internet for those professions and most others, you are talking with people who have experienced the results of the work – not just the process of the work. In my profession, people can recommend me because they liked “my bedside manner” or they enjoyed the process, but they are taking it on “trust” that I have designed an Estate Plan that works well. It is why many people make a determination on their Estate Planning based upon price. They do not know what they do not know so they call our office and ask how much we charge. They generally would not select a medical doctor in that way, but to have their Living Trust or Will done, they very well may. Even wealthy clients fall into this trap or decide to put off planning. That is why as they get older, they begin to sell assets that they would like to keep in the family, but that they do not have the liquidity to keep and to pay the estate tax. I frequently use Sam Walton as an example of a great businessman who understood that it was not just about building, but also about retaining. Not only did he build the biggest company in the world and become at the time of his death in 1992 the richest (or second richest) man in the world, but he engaged in Estate Planning from the beginning of the creation of Wal-Mart. His family – he had a wife and four children – benefitted immensely. From 1992 until 2005, five of the ten richest people in the United States were the Waltons. This was true despite upon his death there being an estate tax rate of 55%.

Sam Walton was proactive in his Estate Planning. In fact he utilized GRATs (Grantor Retained Annuity Trusts) to such a degree and in such a manner that there is now in the Estate Planning community a special type of GRAT known as the Walton GRAT. The important point to understand is that Estate Planning attorneys can be of benefit and not just for the very wealthy. We can structure Estate Plans for people that do not have taxable estates so that their children’s assets are protected from divorce, creditors, lawsuits, and their own spending. Comments are closed.

|

Categories

All

Michael Burstein

Estate Planning and Probate Attorney, Manhattan Beach Local, Sports Enthusiast

Archives

April 2023

|

|

LOS ANGELES

3611 Motor Avenue, Suite 220 Los Angeles, California 90034 Tel: (310) 391-1311 Fax: (310) 391-4853 |

MANHATTAN BEACH

111 North Sepulveda Blvd. Suite 250 Manhattan Beach, California 90266 Tel: (310) 545-7878 |

Connect With Us

|

RSS Feed

RSS Feed